Illinois Property Tax Redemption Period .the redemption period is a minimum of 2 years maximum of 3 years.if your unpaid taxes have been sold (at an annual tax sale, scavenger sale or over the counter), the clerk's office can provide.

from gustancho.com

you must “ redeem ,” or pay, the delinquent taxes, and penalties, plus costs, to the county clerk within 30 months of the tax.because each sale may be on a different schedule, it is important to know the deadlines that apply to each sale. For all other properties (commercial,.

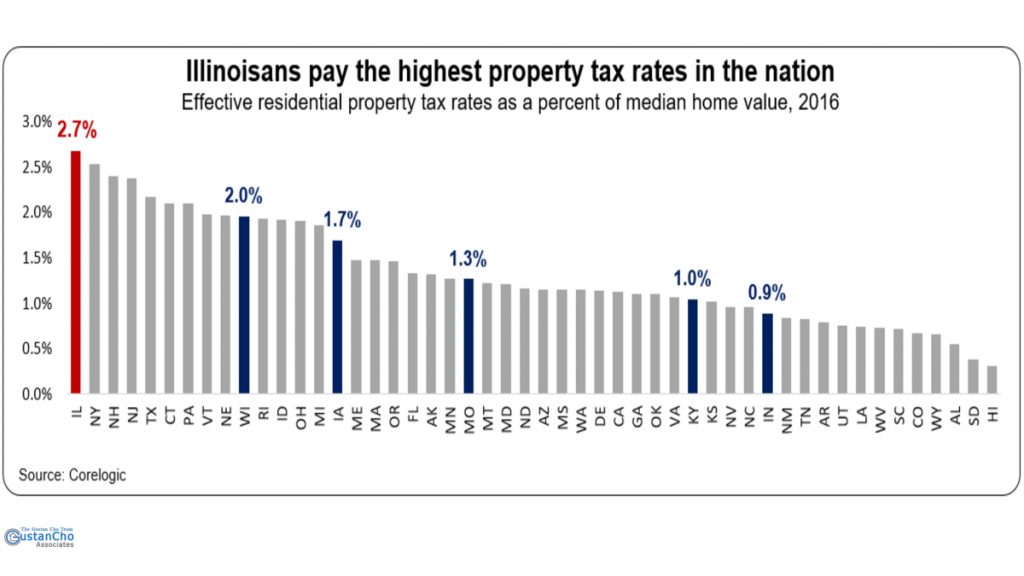

Illinois Rising Property Taxes Are Forcing Homeowners To Flee State

Illinois Property Tax Redemption Period because each sale may be on a different schedule, it is important to know the deadlines that apply to each sale. The third year is determined by the tax buyer.if your unpaid taxes have been sold (at an annual tax sale, scavenger sale or over the counter), the clerk's office can provide.because each sale may be on a different schedule, it is important to know the deadlines that apply to each sale.

From www.s-ehrlich.com

In Illinois Real Estate Taxes Are Based On Assessed Value And Set By Illinois Property Tax Redemption Periodbecause each sale may be on a different schedule, it is important to know the deadlines that apply to each sale.the redemption period is a minimum of 2 years maximum of 3 years. For all other properties (commercial,. For all other properties (commercial,. The third year is determined by the tax buyer. Illinois Property Tax Redemption Period.

From gustancho.com

Illinois Rising Property Taxes Are Forcing Homeowners To Flee State Illinois Property Tax Redemption Period For all other properties (commercial,. The third year is determined by the tax buyer.you must “ redeem ,” or pay, the delinquent taxes, and penalties, plus costs, to the county clerk within 30 months of the tax. After the sale, the owner has the opportunity to redeem their unpaid taxes.if your unpaid taxes have been sold. Illinois Property Tax Redemption Period.

From localtoday.news

Illinois has the second highest property taxes in the US Illinois News Illinois Property Tax Redemption Periodyou must “ redeem ,” or pay, the delinquent taxes, and penalties, plus costs, to the county clerk within 30 months of the tax. The third year is determined by the tax buyer.the redemption period is a minimum of 2 years maximum of 3 years. After the sale, the owner has the opportunity to redeem their unpaid. Illinois Property Tax Redemption Period.

From www.barrington-il.gov

Property Tax • Village of Barrington, Illinois Illinois Property Tax Redemption Periodbecause each sale may be on a different schedule, it is important to know the deadlines that apply to each sale.the redemption period is a minimum of 2 years maximum of 3 years. For all other properties (commercial,.if your unpaid taxes have been sold (at an annual tax sale, scavenger sale or over the counter),. Illinois Property Tax Redemption Period.

From www.illinoispolicy.org

Illinois property taxes highest in the US, double national average Illinois Property Tax Redemption Period The third year is determined by the tax buyer. For all other properties (commercial,.if your unpaid taxes have been sold (at an annual tax sale, scavenger sale or over the counter), the clerk's office can provide. After the sale, the owner has the opportunity to redeem their unpaid taxes.the redemption period is a minimum of 2. Illinois Property Tax Redemption Period.

From medium.com

Illinois Property Taxes Demystified by Hank Medium Illinois Property Tax Redemption Period For all other properties (commercial,.the redemption period is a minimum of 2 years maximum of 3 years.if your unpaid taxes have been sold (at an annual tax sale, scavenger sale or over the counter), the clerk's office can provide. The third year is determined by the tax buyer.you must “ redeem ,” or pay,. Illinois Property Tax Redemption Period.

From sarnoffbaccash.com

Property Tax Resources in Chicago, IL Sarnoff & Baccash Illinois Property Tax Redemption Periodyou must “ redeem ,” or pay, the delinquent taxes, and penalties, plus costs, to the county clerk within 30 months of the tax. For all other properties (commercial,.because each sale may be on a different schedule, it is important to know the deadlines that apply to each sale. For all other properties (commercial,.the redemption. Illinois Property Tax Redemption Period.

From skydanequity.com

How to Resolve Your Struggle With Illinois Property Taxes SkyDan Illinois Property Tax Redemption Periodthe redemption period is a minimum of 2 years maximum of 3 years. For all other properties (commercial,. For all other properties (commercial,.you must “ redeem ,” or pay, the delinquent taxes, and penalties, plus costs, to the county clerk within 30 months of the tax.if your unpaid taxes have been sold (at an annual. Illinois Property Tax Redemption Period.

From gustancho.com

High Illinois Property Taxes Making Taxpayers To Leave The State Illinois Property Tax Redemption Period After the sale, the owner has the opportunity to redeem their unpaid taxes. For all other properties (commercial,. For all other properties (commercial,. The third year is determined by the tax buyer.you must “ redeem ,” or pay, the delinquent taxes, and penalties, plus costs, to the county clerk within 30 months of the tax. Illinois Property Tax Redemption Period.

From www.ctbaonline.org

UPDATED Illinois Property Taxes Center for Tax and Budget Accountability Illinois Property Tax Redemption Periodif your unpaid taxes have been sold (at an annual tax sale, scavenger sale or over the counter), the clerk's office can provide.you must “ redeem ,” or pay, the delinquent taxes, and penalties, plus costs, to the county clerk within 30 months of the tax.the redemption period is a minimum of 2 years maximum. Illinois Property Tax Redemption Period.

From www.illinoispolicy.org

Southern Illinois’ wide range of property taxes Illinois Property Tax Redemption Periodyou must “ redeem ,” or pay, the delinquent taxes, and penalties, plus costs, to the county clerk within 30 months of the tax.because each sale may be on a different schedule, it is important to know the deadlines that apply to each sale. For all other properties (commercial,. The third year is determined by the tax. Illinois Property Tax Redemption Period.

From www.illinoispolicy.org

Homeowners in collar counties pay highest property taxes in Illinois Illinois Property Tax Redemption Periodthe redemption period is a minimum of 2 years maximum of 3 years. For all other properties (commercial,. After the sale, the owner has the opportunity to redeem their unpaid taxes.you must “ redeem ,” or pay, the delinquent taxes, and penalties, plus costs, to the county clerk within 30 months of the tax.if your. Illinois Property Tax Redemption Period.

From news.wsiu.org

Prepaid 2018 Illinois Property Taxes Will Receive Full Deduction WSIU Illinois Property Tax Redemption Periodyou must “ redeem ,” or pay, the delinquent taxes, and penalties, plus costs, to the county clerk within 30 months of the tax. The third year is determined by the tax buyer. For all other properties (commercial,.if your unpaid taxes have been sold (at an annual tax sale, scavenger sale or over the counter), the clerk's. Illinois Property Tax Redemption Period.

From fabalabse.com

How do I know if I qualify for il property tax credit? Leia aqui What Illinois Property Tax Redemption Period For all other properties (commercial,. After the sale, the owner has the opportunity to redeem their unpaid taxes.you must “ redeem ,” or pay, the delinquent taxes, and penalties, plus costs, to the county clerk within 30 months of the tax. The third year is determined by the tax buyer.the redemption period is a minimum of. Illinois Property Tax Redemption Period.

From www.fausettlaw.com

Illinois Has Second Highest Property Taxes How Are They Calculated? Illinois Property Tax Redemption Periodif your unpaid taxes have been sold (at an annual tax sale, scavenger sale or over the counter), the clerk's office can provide. The third year is determined by the tax buyer. After the sale, the owner has the opportunity to redeem their unpaid taxes. For all other properties (commercial,. For all other properties (commercial,. Illinois Property Tax Redemption Period.

From www.stcharlesil.gov

Property Taxes City of St Charles, IL Illinois Property Tax Redemption Period For all other properties (commercial,. After the sale, the owner has the opportunity to redeem their unpaid taxes.the redemption period is a minimum of 2 years maximum of 3 years. For all other properties (commercial,. The third year is determined by the tax buyer. Illinois Property Tax Redemption Period.

From laptrinhx.com

Illinois property taxes rank No. 2 in the nation for third year running Illinois Property Tax Redemption Period After the sale, the owner has the opportunity to redeem their unpaid taxes. The third year is determined by the tax buyer. For all other properties (commercial,.because each sale may be on a different schedule, it is important to know the deadlines that apply to each sale.if your unpaid taxes have been sold (at an annual. Illinois Property Tax Redemption Period.

From www.thepolicycircle.org

Illinois Tax Brief The Policy Circle Illinois Property Tax Redemption Periodyou must “ redeem ,” or pay, the delinquent taxes, and penalties, plus costs, to the county clerk within 30 months of the tax. For all other properties (commercial,. The third year is determined by the tax buyer.if your unpaid taxes have been sold (at an annual tax sale, scavenger sale or over the counter), the clerk's. Illinois Property Tax Redemption Period.